- See the 2023 price changes for QuickBooks Desktop and QuickBooks Online

- Learn how the changes might affect your 2023 budget

- Consider alternatives to QuickBooks and other integrations

What’s up with Quickbooks?

Answer: the price! And that poses challenges for small businesses that rely on QuickBooks for accounting and other tasks such as payroll.

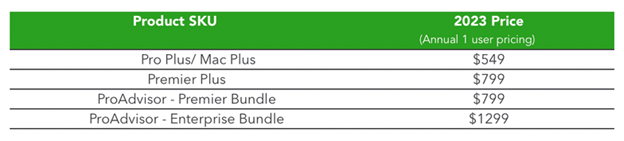

QuickBooks Desktop Price Increases

Many small businesses have managed their bookkeeping for years with QuickBooks (QB) for very nominal fees. If they added the Payroll feature, their cost went up a little, depending on how many employees needed to be processed regularly.

In August 2022, however, Intuit announced hefty increases in all product lines. When your QB license is up for renewal in 2023, be prepared for sticker shock. Also, pricing will be on an annual basis going forward.

Details about 2023 QuickBooks Desktop prices:

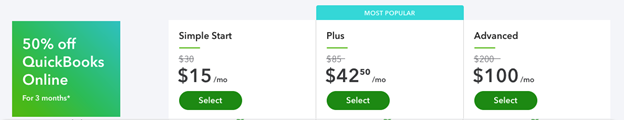

Intuit currently offers a 50% discount for the first 3 months for each plan.

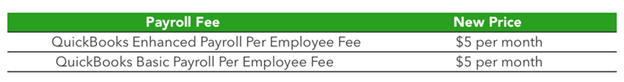

If you include the Payroll feature with your subscription, the following increases will occur when your license renews in 2023. Subscriptions that have a monthly per-employee fee will incur the following price changes as of October 1, 2022. No discount is available for the Payroll feature.

QuickBooks Online Pricing

Intuit is heavily promoting QuickBooks Online (QBO) as a solution for small businesses. Here’s the introductory pricing.

Notice the regular pricing per year for each plan:

QBO Simple Start = $360 QBO Plus = $1,020 QBO Advanced = $2,400

Careful review of the features

included in each plan will help you determine which one is right for your

business.

What Should Small Business Owners Do?

Price increases of this magnitude can cause financial

headaches for businesses already coping with inflation and other challenges.

And changing bookkeeping software can be difficult, even risking loss or

corruption of data. Nevertheless, it is important to consider all options.

Whether to continue with the desktop version of QB or opt

for the online version depends partly on the type of business. With only a few

employees who are not working remotely, it might make sense to stick with the

desktop version.

With 25 or more employees who need to access QuickBooks from

any location or device, QBO makes sense.

Caution: The online version of QuickBooks does not look

or work exactly like the desktop version. Adjusting to the online version might

require training and time.

Further, the desktop version allows a user to save a

snapshot of the data at any time. This can be useful if subsequent data entry

errors or corruption require reverting to an earlier set of data. The online

version does not offer this feature. In QBO, data are immediately saved and

backed up; no prior data sets are available for retrieval.

What About Competitors?

Currently, QuickBooks commands about 75% of the bookkeeping

software market. Nevertheless, some competitors offer more robust accounting

features that your business might need, depending on size and complexity.

Before your QuickBooks subscription renews for 2023, Intuit’s price increases

might provide sufficient reason to check out alternatives.

NetSuite,

from Oracle, is a robust collection of online modules that go beyond

bookkeeping to manage sophisticated accounting needs. For example, NetSuite’s

accounts payable feature allows for more detailed control than QB offers of who

has access to which data according to their company role. Their accounts

receivable module can forecast and record revenue from contracts with milestone

billing and contract renewal—features not found in QB. Perhaps most important

for some businesses, NetSuite includes sophisticated inventory management.

Modules can be purchased separately so that pricing varies according to what

you include in your package.

FreshBooks is

cloud-based accounting software for solopreneurs and businesses with employees.

Its standard “Premium” plan costs $55 per month or $660 per year (60% off for

first 4 months) for unlimited billable clients. A slightly less robust plan for

50 billable clients costs $360 per year. Payroll can be added through

integration with Gusto, a premier payroll and

HR vendor. If your business is small and not growing quickly, FreshBooks could

be a much lower-cost alternative to QBO.

Ultimately, you might decide to stick with QuickBooks

regardless of the increased price. Doing so means not confronting the hassle of

migrating your data to a different vendor. In addition, once your team learns

how to navigate QBO (provided that its features provide everything you are

accustomed to having), you can proceed with software that gets the job done for

many businesses.

Otherwise, if your business is growing rapidly and becoming more

complex, you might need more sophisticated accounting features built-in. In

that case, going with a vendor like NetSuite makes some sense. And if lower

cost for relatively basic business bookkeeping is crucial, FreshBooks offers an

attractive alternative.

Finally, it’s always a good idea to investigate how well the

accounting software you select integrates with other software and procedures

that your business needs. Look before you leap.

If you need assistance in making a strategic decision, Now

IT Works can help. Get in touch to arrange a consultation.